Insights & Guides

Plastic Packaging Tax: Explained

- The Plastic Packaging Taxis a new tax introduced on 1st April 2022. The tax is designed to encourage the use of more recycled plastic and applies to plastic packaging produced in, or imported into, the UK, and that does not contain at least 30% recycled plastic.

- The Plastic Packaging Tax applies to businesses that manufacture or import plastic packaging components or import packaged goods into the UK.

- Small operators who import or manufacture less than 10 tonnes of plastic packaging per year are exempt from paying the tax. Once a business meets the 10 tonnes de minimis, it must register with HMRC. All businesses are required to report plastic packaging data and pay for the tax quarterly.

- Multi-material components are classed as plastic packaging if they are predominantly plastic by weight. A component must meet the following definition of ‘packaging’ to be liable for the tax:

“Is a product that is designed to be suitable for use, whether alone or in combination with other products, in the containment, protection, handling, delivery or presentation of goods at any stage in the supply chain of the goods, from the producer of the goods to the consumer or user.”

- Recycled plastic is plastic that has been reprocessed from recovered material by using a chemical or manufacturing process so that it can be used either for its original purpose or for other purposes. This does not include organic recycling.

Who pays the tax?

- The responsibility for paying the Plastic Packaging Tax falls predominantly with importers of filled or unfilled plastic packaging and UK manufacturers of plastic packaging.

- The business that completes the ‘last substantial modification’ to the plastic packaging or component is liable for the tax. If the last substantial modification is made at the point where empty packaging is filled with goods/products, then it will be the substantial modification point prior to this.

- Care and due diligence will be applied to the tax point. If you believe the Plastic Packaging Tax should have been paid before the packaging reaches your business, and it is not clearly stated on invoices, you may face secondary liability.

At what point does the tax apply?

- HMRC defines the plastic components as liable for the tax when ‘finished’. This is when the last substantial modification is made.

- For plastic packaging that is imported into the UK and already contains goods or products, the tax applies to the packaging when they are imported, with no additional substantial modifications made.

- The last substantial modification is the last manufacturing process that makes a significant change to the nature of the packaging component, as it alters one of the following characteristics of the packaging component:

-

- Shape

- Structure

- Thickness

- Weight

- For other packaging, it will be the last substantial modification before the packaging is filled with products. This includes extrusion, moulding, layering, and laminating, forming, and printing. Not all manufacturing processes that change the shape or structure are considered as a substantial modification. For example:

-

- blowing or otherwise forming a packaging component from a preform;

- cutting film to size or cutting formed trays out of a sheet;

- gluing labels to a tub or heating a shrink film label onto a bottle;

- sealing, such as attaching a film lid to a tub.

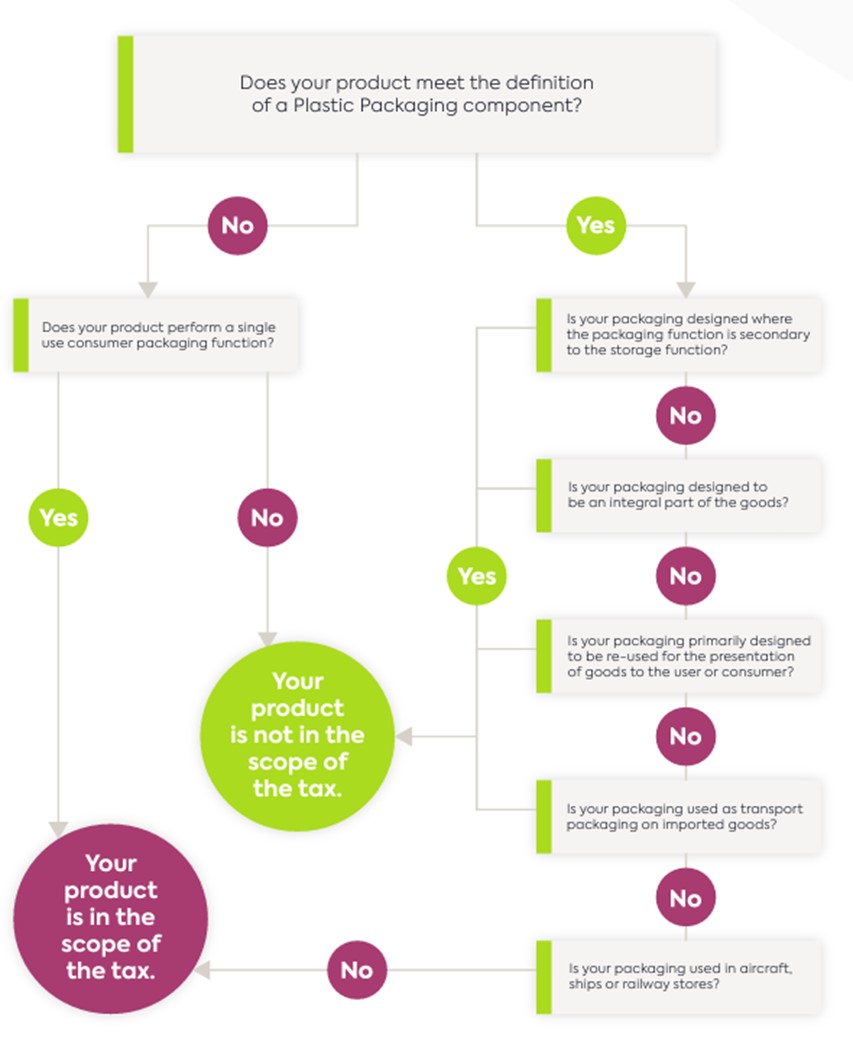

Decision Tree – Plastic Packaging Tax: Are you liable?